Innovating asset-backed lending

Future-proof your asset-backed lending business by combining unparalleled asset intelligence with efficient back-office automation.

Use Cases for Funders

Your end-to-end origination engine

Receive tailored origination opportunities, along with due diligence and structuring support, from Zeti’s Commercial team across a broad network of mobility and energy operators seeking traditional and flexible financing.

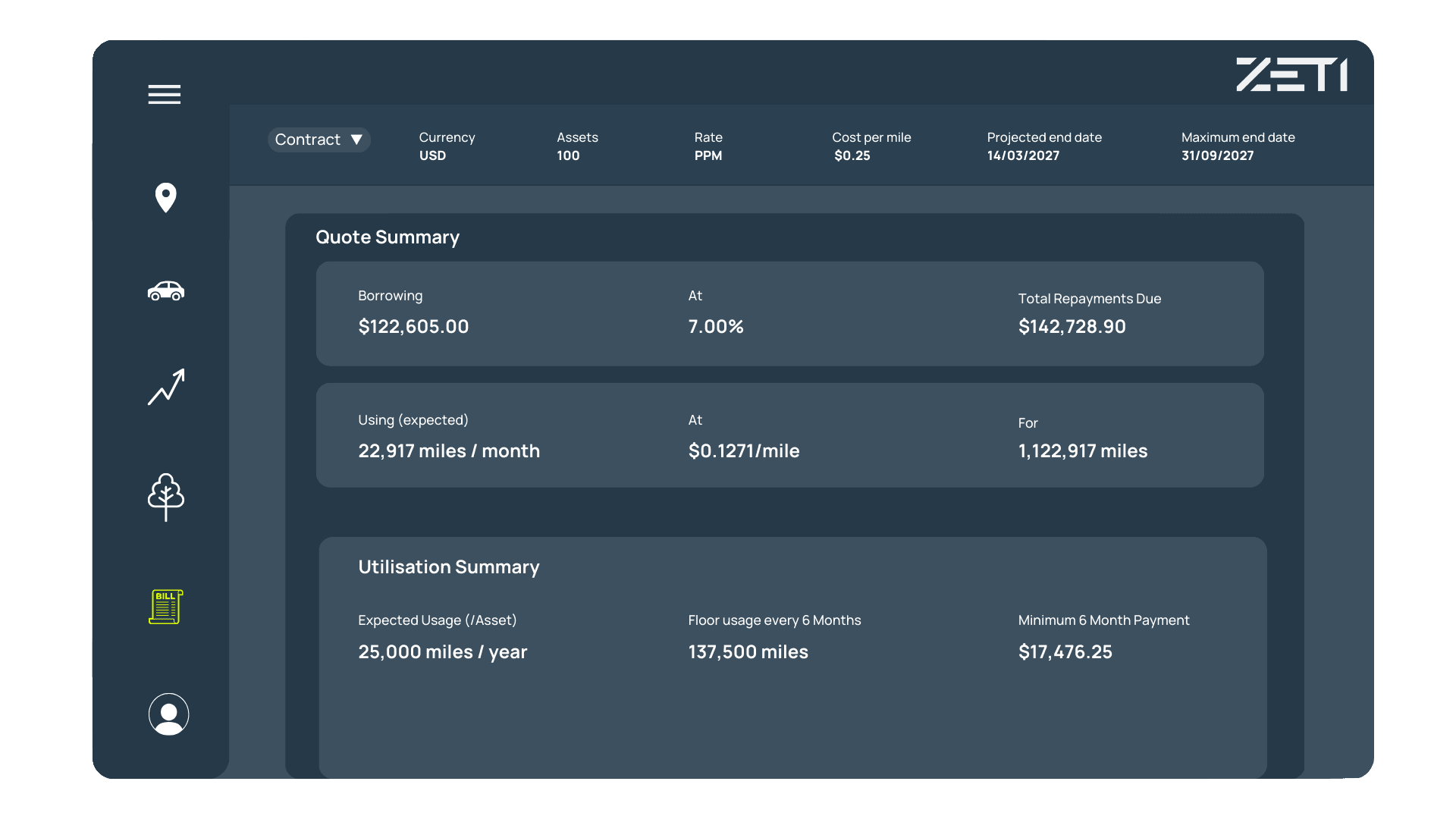

Through ZetiOS, digitise your pricing engine and processes to quickly generate both fixed and utilisation-based finance quotes across multiple asset classes. Share quotes in both interactive and PDF formats, and track your customers’ engagement with them.

Soon, implement your own credit decisioning engine and allow our AI to evaluate borrower financial data and produce supplementary underwriting advice.

Robust, efficient invoice and payment automation

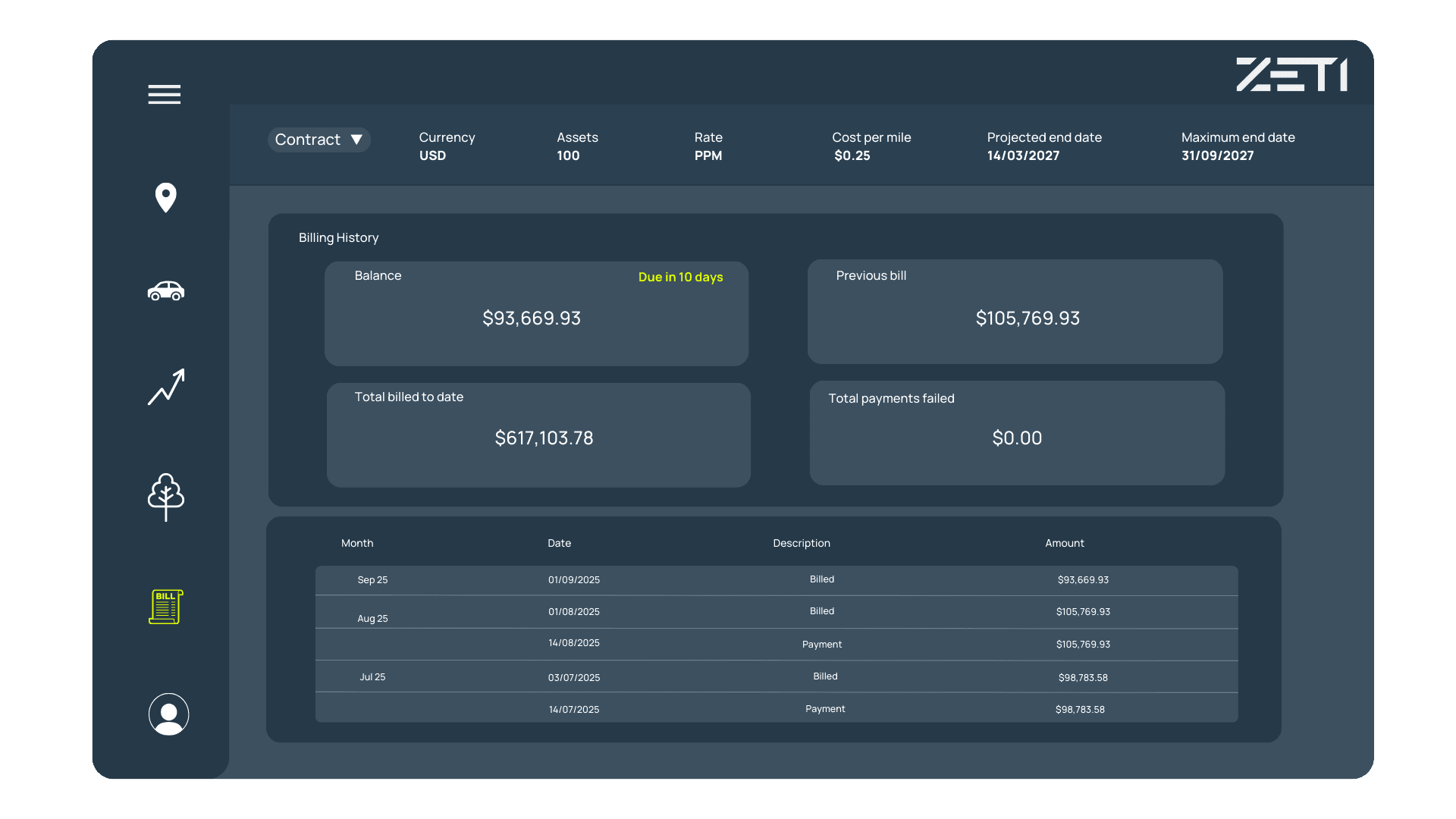

ZetiOS fully automates loan and lease servicing, streamlining your accounts receivable processes. It calculates invoice amounts based on fixed repayment schedules or variable utilisation-based contracts. It creates interactive HTML invoices, with supporting PDFs, allowing clear explanation of individual charges. It issues invoices promptly according to preferred delivery channels and triggers payment collection in line with contractual payment terms via leading payment processors. This allows funders to see real-time repayment progress, with automatic retries in the event of payment failure.

ZetiOS also provides self-service portals for funders and borrowers to view historic invoices and payments for accounting purposes.

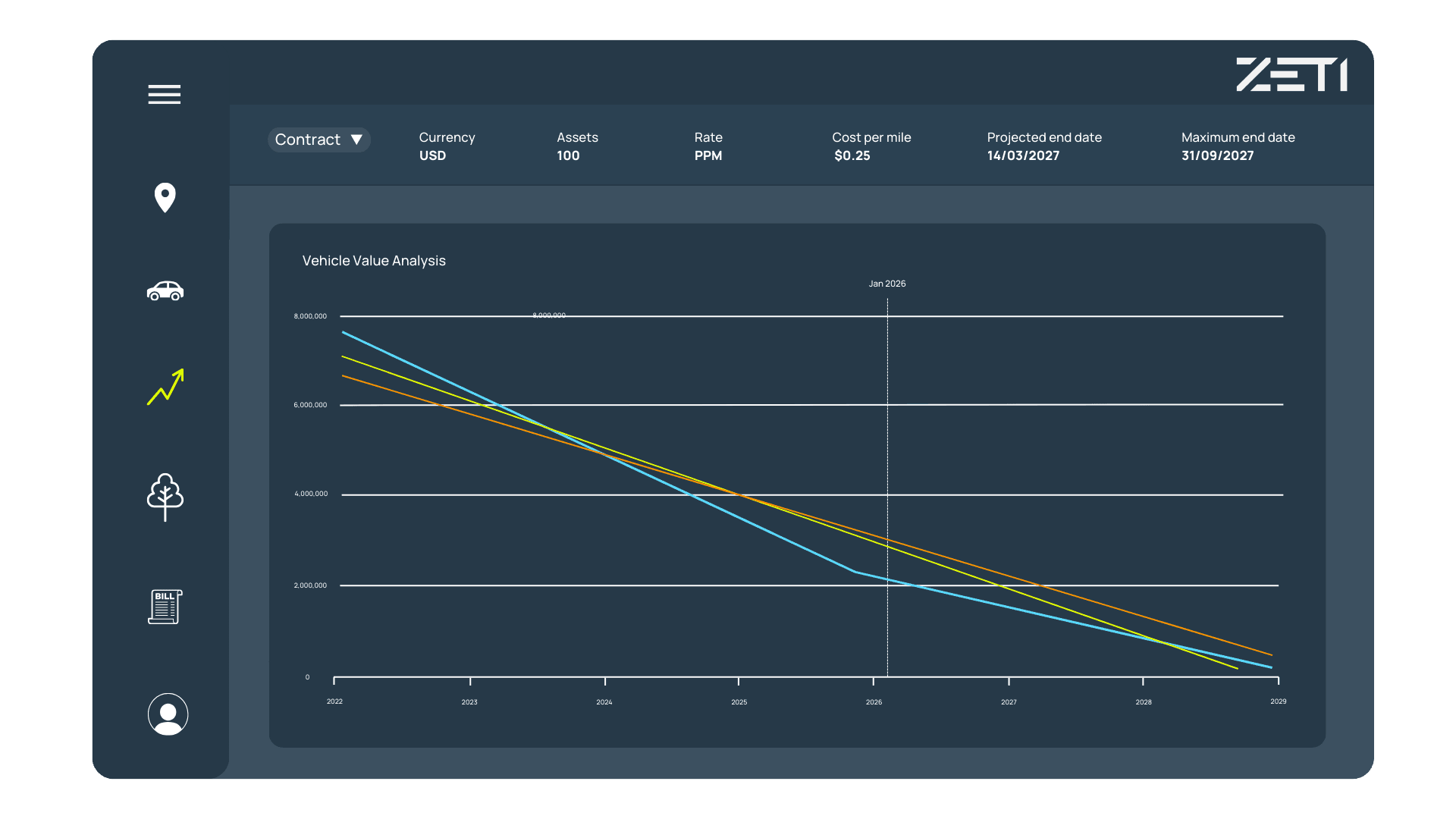

Live portfolio performance insight at your fingertips

View a snapshot of deal performance at any moment, powered by ZetiOS’s dynamic calculations and projections. Access unrealised IRR figures based on historical and forecast cash flows for both fixed and variable finance contracts. Identify positive and negative performance trends through reporting and drill down into the underlying drivers at a granular, per-asset level.

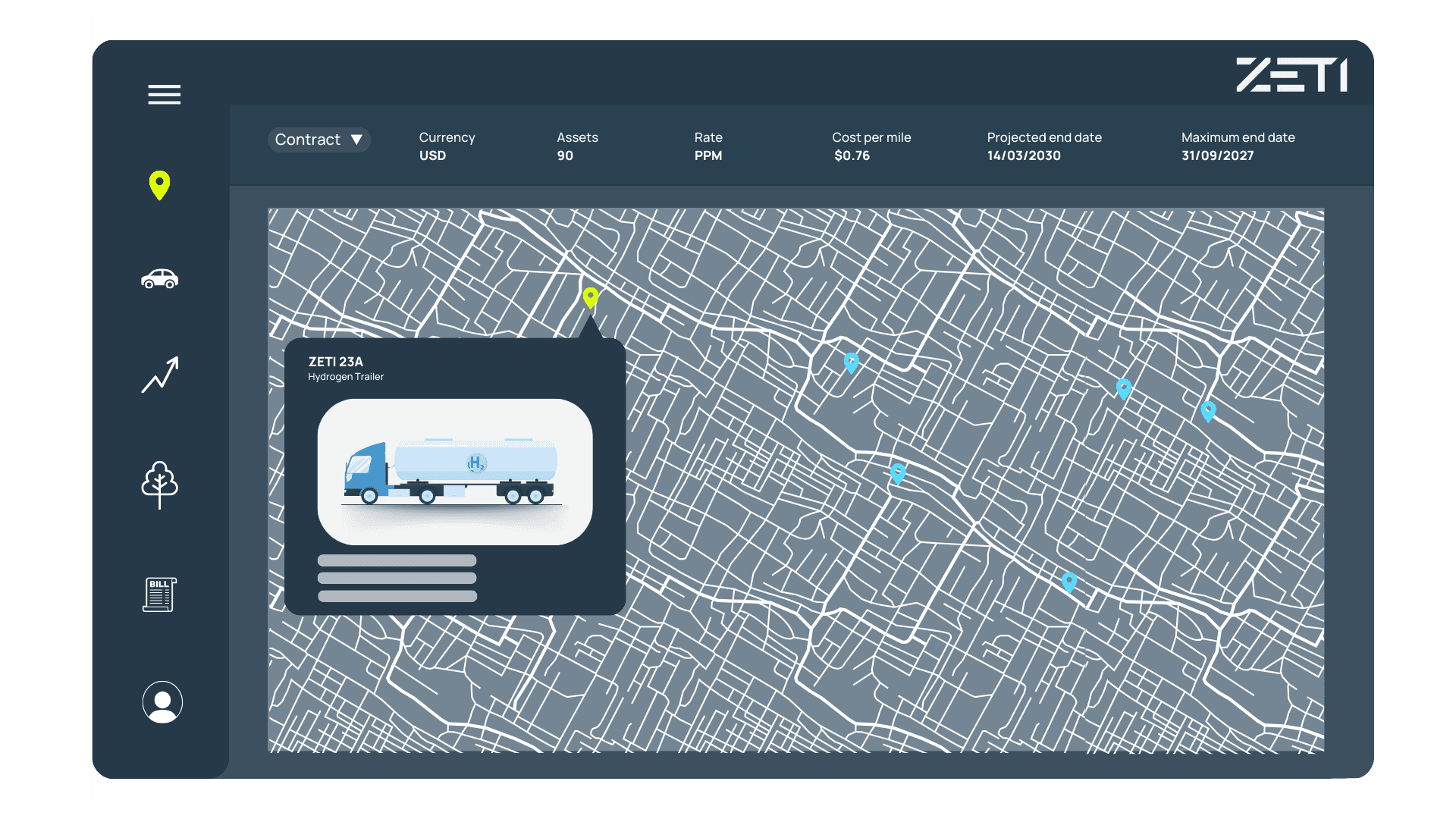

Game-changing, multi-source asset intelligence

Transform asset risk monitoring through ZetiOS’s extensive asset data integrations. Using asset telematics, gather detailed utilisation insights, understand asset condition by identifying faults, incidents and issues in real time, and access live asset locations to accelerate asset recovery in the event of default.

By combining industry-leading market value data with digitised loan and lease balances, assess real-time collateral adequacy. Monitor maintenance and tax status through integrations with third-party services, including GOV.UK’s MOT and Vehicle Enquiry Service.

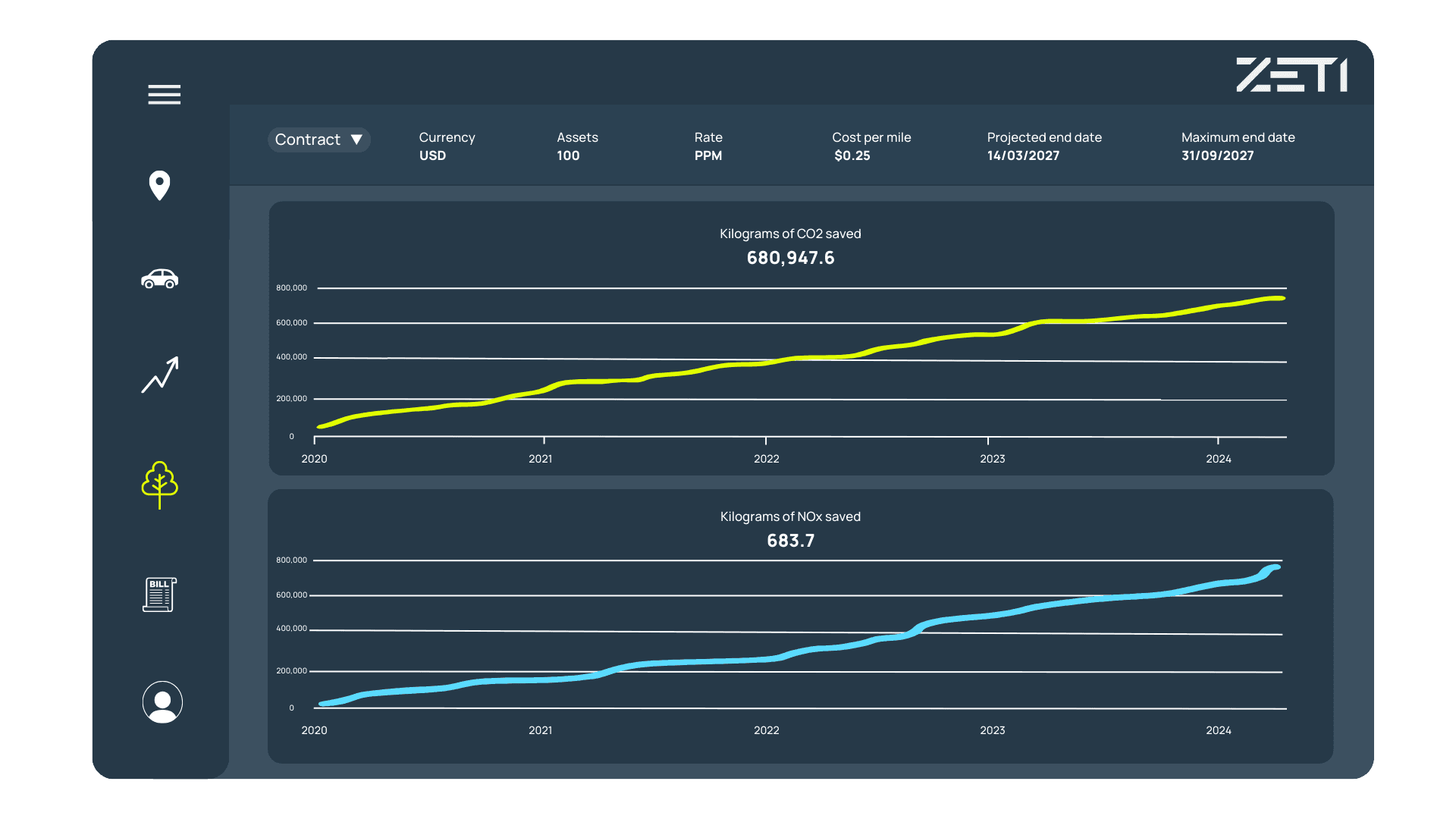

Emissions avoidance reported in real time

Calculate emissions avoidance using live telemetry data rather than projections. Apply savings per unit of usage, such as miles or operating hours, to an asset’s live meter, for example a vehicle odometer, to calculate CO₂ emissions on an ongoing basis. Conduct advanced geospatial analysis on mobile assets by automatically visualising NOx emissions savings on a heatmap.

“We are thrilled to partner with Zeti and deliver funding for zero-emission cars through an innovative pay-per-use model. We look forward to building on this collaborative approach, working with Zeti to deliver financing solutions aligned to vehicle usage, and continuing to help UK SMEs play their part in reaching net zero.”

Matthew Bass

Head of Specialist Lending

Paragon Bank

Ready to future-proof your asset-backed lending business?

Join leading financial institutions using Zeti to power their asset finance operations.